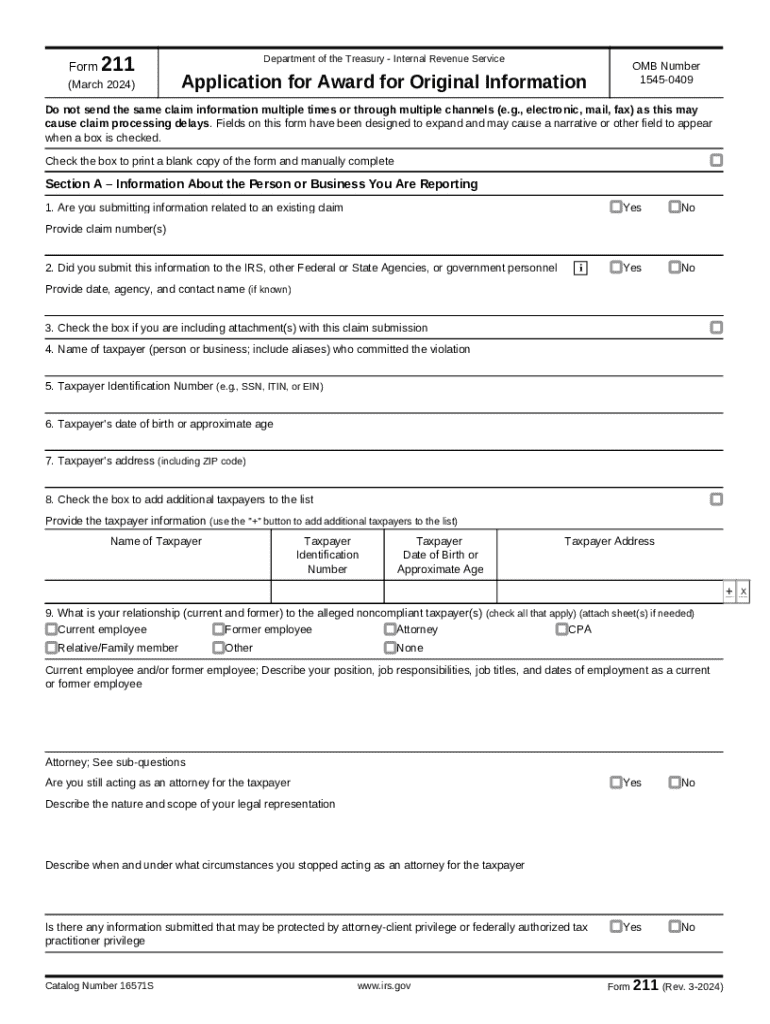

What is IRS Form 211?

Form 211 is the Internal Revenue Service template officially called "Application for Award for Original Information." The purpose of this document is for individuals to provide credible information regarding any significant tax evasions, violations, or underpayments committed by other taxpayers and to claim an award for that.

The IRS demands that the information provided is valid rather than mere speculation. Whistleblowers file their 211 form under penalty of perjury; therefore, only accurate information regarding gross tax law breaches should be reported. Suppose the given information helped collect taxes, penalties, interest, or other amounts from the declining taxpayer. In that case, the whistleblower may be eligible for an award of up to 30% of the due payment. Information from the completed form 211 is to be inspected by the IRS officers to ensure the proper amount of tax is paid, and the claimant will be given a corresponding award.

Who should file the 211 form?

An individual who possesses information about other individuals' failure to pay their taxes should inform the IRS about such violations and submit the IRS form 211 to claim their reward. However, some citizens aren't eligible for claiming such an award. For instance: current or previous employees of the Department of Treasury, staff of the Federal, State, or Local Government. Also, anonymous whistleblowers, corporations, or partnerships can't apply for a reward under the 211 form.

What information do you need when you file the 211 form?

IRS form 211 is divided into two parts:

- Section A provides information about who violated the taxpaying procedure. It includes questions regarding the reported person's name, date of birth, address, last four digits of the taxpayer's identification number - SSN, EIN, or ITIN. Here you should describe the type of violation, how you found out about it, your relationship with the taxpayer, and the amount of taxes they owe.

- Section B is for information about the whistleblower. Here you should provide your details (name, date of birth, address, telephone, and last four digits of SSN or ITIN) and whether you're an employee or contractor in the IRS or working for Federal, State, or Local Government.

How do you fill out the 211 form?

You can fill out and sign form 211 on paper or quickly complete it electronically. However, keep in mind that the IRS requires individuals to send these reports only by mail.

To complete your claim electronically, follow the steps below:

- Upload your IRS form 211 to the editor using the Get Form button.

- Complete the sample by checking whether it's a new or additional submission.

- Move to the next question by clicking Next.

- Add the date and click on the Signature field to legally eSign your document.

- Verify that you've filled out all areas correctly and that all information provided is complete and accurate.

- Click Done to finish editing and choose to download, print out your 211 form, or send it via USPS right from the editor.

Is form 211 accompanied by other forms?

The IRS form 211 is not accompanied by other tax reports. However, depending on the claimant's answers on the completed form 211, you may need to attach certain supporting documents as evidence to your words: proof of the relationship between you as the claimant and the alleged non-taxpayer, information about involvement in the legal proceedings, financial records, contracts, etc.

When is 211 form due?

There is no deadline for this report. Individuals should file when a specific reason arises.

Where do I send the 211 form?

When your form 211 is ready, please send it by mail along with all the supporting documentation to the following address:

Internal Revenue Service

Whistleblower Office - ICE

1973 N. Rulon White Blvd.

M/S 4110

Ogden, UT 84404